Jumbo Loan: Tailored Home Mortgage Solutions for High-Income Customers

Jumbo Loan: Tailored Home Mortgage Solutions for High-Income Customers

Blog Article

Optimizing Your Home Acquiring Potential: An In-Depth Consider Jumbo Finance Funding Options

Navigating the complexities of jumbo car loan funding can dramatically enhance your home purchasing possible, particularly for high-value buildings that exceed conventional car loan limitations. Recognizing the qualification needs, consisting of the need for a durable credit report and substantial down repayment, is vital for potential purchasers (jumbo loan). The competitive landscape of interest prices and associated fees presents both challenges and chances. As you take into consideration these factors, the question stays: just how can you tactically setting yourself to maximize these financing alternatives while minimizing threats?

Recognizing Jumbo Fundings

In the realm of home loan funding, jumbo financings function as a critical choice for borrowers looking for to purchase high-value residential properties that exceed the adapting car loan restrictions set by government-sponsored business. Typically, these limitations differ by region and are determined yearly, often reflecting the regional real estate market's dynamics. Big lendings are not backed by Fannie Mae or Freddie Mac, which differentiates them from conventional fundings and introduces different underwriting criteria.

These loans typically feature higher rates of interest as a result of the perceived risk associated with bigger car loan quantities. Consumers who go with jumbo financing typically call for an extra extensive financial profile, including higher credit score scores and lower debt-to-income proportions. In addition, big finances can be structured as fixed-rate or adjustable-rate home mortgages, permitting consumers to pick a settlement strategy that lines up with their monetary goals.

The relevance of jumbo fundings prolongs beyond mere funding; they play a crucial duty in the high-end property market, enabling customers to get residential or commercial properties that represent significant financial investments. As the landscape of home loan choices evolves, understanding big financings comes to be necessary for navigating the intricacies of high-value residential or commercial property acquisitions.

Qualification Requirements

To qualify for a big financing, debtors should meet certain eligibility needs that vary from those of conventional funding. One of the key requirements is a higher credit history, usually requiring a minimum of 700. Lenders examine creditworthiness carefully, as the enhanced lending quantities involve better danger.

Additionally, big lending candidates typically need to give proof of substantial revenue. Numerous lending institutions favor a debt-to-income ratio (DTI) of 43% or reduced, although some may enable approximately 50% under specific circumstances. This makes certain debtors can manage their monthly settlements without monetary strain.

Moreover, significant properties or reserves are usually required. Lenders may request for at least 6 months' well worth of mortgage repayments in fluid assets, demonstrating the debtor's capacity to cover expenditures in case of earnings interruption.

Finally, a larger down payment is popular for jumbo loans, with several loan providers anticipating a minimum of 20% of the acquisition cost. This need alleviates risk for lending institutions and indicates the consumer's commitment to the financial investment. Meeting these rigid eligibility requirements is important for safeguarding a jumbo loan and effectively browsing the high-end property market.

Rate Of Interest Prices and Fees

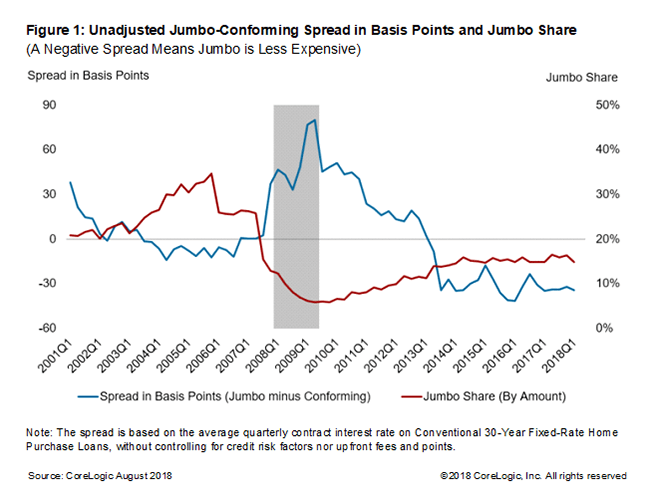

Recognizing the complexities of interest prices and fees connected with jumbo fundings is important for possible customers. Unlike adjusting financings, jumbo lendings, which surpass the conforming financing limits established by Fannie Mae and Freddie Mac, usually featured higher rates of interest. This increase is attributable to the viewed threat loan providers tackle in funding these larger financings, as they are not backed by government-sponsored enterprises.

Passion prices can vary significantly based upon a number of factors, including the consumer's credit history, the loan-to-value ratio, and market conditions. It is vital for debtors to look around, as various lending institutions might supply differing terms and prices. In addition, big financings might entail greater costs, such as source charges, evaluation charges, and personal home loan insurance coverage (PMI) if the deposit is less than 20%.

To lessen prices, consumers must carefully review the cost frameworks of various lending institutions, as some might use reduced rates of interest however greater charges, while others may provide a more balanced approach. Ultimately, understanding these components helps borrowers make educated choices and maximize their funding choices when acquiring high-end residential properties.

Advantages of Jumbo Loans

Jumbo car loans use considerable advantages for customers looking for to acquire high-value buildings. Among the main benefits is that they provide accessibility to funding that goes beyond the adjusting funding limitations set by the Federal Housing Financing Company (FHFA) This allows buyers to safeguard bigger loan amounts, making it feasible to obtain glamorous homes or residential properties in very in-demand locations.

Additionally, big financings commonly include competitive interest rates, particularly for debtors with solid credit history profiles. This can result in considerable financial savings over the life of the car loan. In addition, jumbo fundings typically enable a selection of lending terms and structures, supplying flexibility to tailor the financing to fit private lasting objectives and financial situations.

One more secret benefit is the possibility for reduced down payment demands, depending upon the lending institution and borrower certifications. This makes it possible for customers to go into the premium realty market without requiring to devote a substantial in advance funding.

Finally, jumbo loans can offer the possibility for greater cash-out refinances, which can be beneficial for homeowners wanting to tap right into their equity for various other investments or major expenses - jumbo loan. On the whole, big financings can be a reliable tool for those navigating the top tiers of the housing market

Tips for Securing Funding

Protecting financing for a big funding needs careful prep work and a tactical approach, especially given the distinct characteristics of these high-value home mortgages. Begin by assessing your monetary health; a robust credit rating, generally over 700, is critical. Lenders sight this as a sign of reliability, which is essential for jumbo finances that go beyond adhering loan limitations.

Engaging with a home loan broker experienced in big loans can jumbo loan supply valuable insights and access to a bigger range of lending alternatives. By following these suggestions, you can improve your chances of successfully securing financing for your jumbo lending.

Final Thought

To conclude, big finances use one-of-a-kind benefits for customers looking for high-value buildings, given they meet certain qualification criteria. With requirements such as a strong credit rating, reduced debt-to-income ratio, and significant down payments, possible home owners can access high-end property chances. By contrasting rate of interest and teaming up with skilled home mortgage brokers, individuals can boost their home buying potential and make educated economic decisions in the affordable property market.

Browsing the intricacies of big car loan funding can significantly boost your home buying potential, specifically for high-value properties that exceed traditional financing limits.In the world of home loan funding, jumbo car loans offer as an essential choice for borrowers looking for to acquire high-value properties that go beyond the adapting lending restrictions set by government-sponsored ventures. Unlike adhering loans, jumbo finances, which surpass the conforming funding limitations established by Fannie Mae and Freddie Mac, commonly come with greater interest rates. Big loans generally allow for a variety of lending terms and structures, providing flexibility to tailor the financing to fit individual long-term objectives and economic scenarios.

Lenders sight this as a find more sign of reliability, which is important for jumbo financings that go beyond conforming car loan limitations. (jumbo loan)

Report this page